2024 Rate Changes

2024 Minimum Wage Increases

Effective January 1, 2024 and due to the implementation of Senate Bill (SB3) 3, the California minimum wage increased to $16.00 per hour for all employers. Consistent with the current state budget and Welfare & Institutions (W&I) Code sections 4681.6(b), 4691.6(f) and (g), and 4691.9(b) many service providers are eligible to request a rate increase if necessary in order to pay employees the new minimum wage.

Providers with Rates Set by the Department

Community Based Day Programs, In-Home Respite Agencies and Work Activity Programs can use the Department of Developmental Services (DDS) workbook to identify only those costs necessary to increase an employee’s actual hourly wage to the new minimum and associated mandated employer costs such Worker’s Compensation and Social Security. Actual wage and mandated employer cost information for affected employees and total program units for the period of July 2023 through September 2023 or any applicable 3 month period from January 2023 through December 2023 must be submitted. Workbooks can be submitted now and must be submitted to DDS at rateadjustrequest@dds.ca.gov by March 1, 2024. General information about the minimum wage increase and detailed instructions can be found in the link provided above.

Providers with Rates Set through Negotiation by the Regional Centers

All providers with rates set through negotiation utilizing median rates can use the Lanterman Regional Center workbooks located here to identify only those costs necessary to increase an employee’s actual hourly wage to the new minimum and associated mandated employer costs such Worker’s Compensation and Social Security. Actual wage and mandated employer cost information for affected employees and total program units for the period of July 2023 through September 2023 or any applicable 3 month period from January 2023 through December 2023 must be submitted. Workbooks can be submitted now and must be submitted to Lanterman’s Director of Community Services Pablo Ibañez at pibanez@lanterman.org by March 1, 2024.

If you have any questions related to minimum wage rate adjustments contact Pablo Ibañez at 213.252.4928 or pibanez@lanterman.org.

Files

CORRECTED Disclosure Statement/DS1891Electronic Form

If you have a vendor number and receive payment from the regional center, you must complete and return the Applicant/Vendor Disclosure Statement (DS1891). This form became mandatory in 2012 as part of the vendor application process and you are required to update the form every two years OR within 30 days of a change or additional information.

Click here for information to help you complete this form

In our most recent service provider newseltter, we included a link to the electronic version of the Disclosure Statement/DS1891. That link was incorrect.

Click here for the corrected electronic Disclosure Statement

Just a reminder that an updated Disclosure Statement needs to be submitted to the regional center every two years.

Files

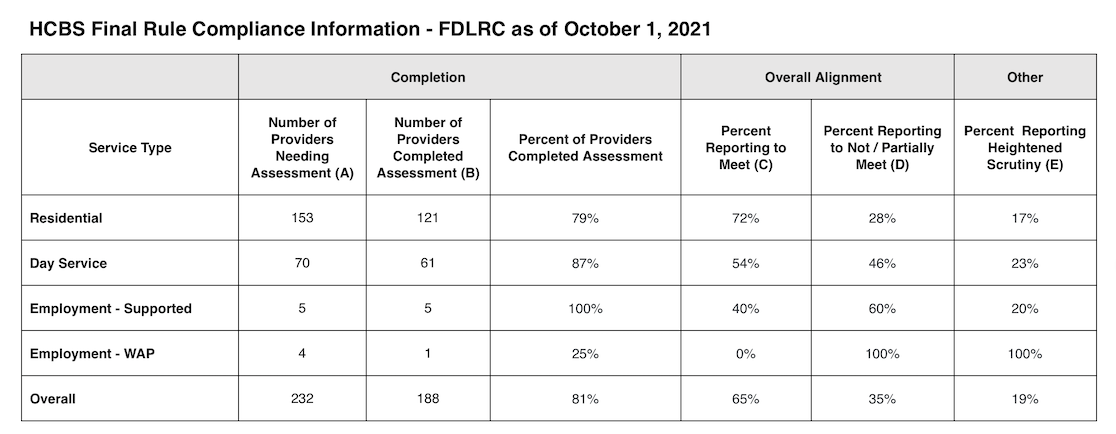

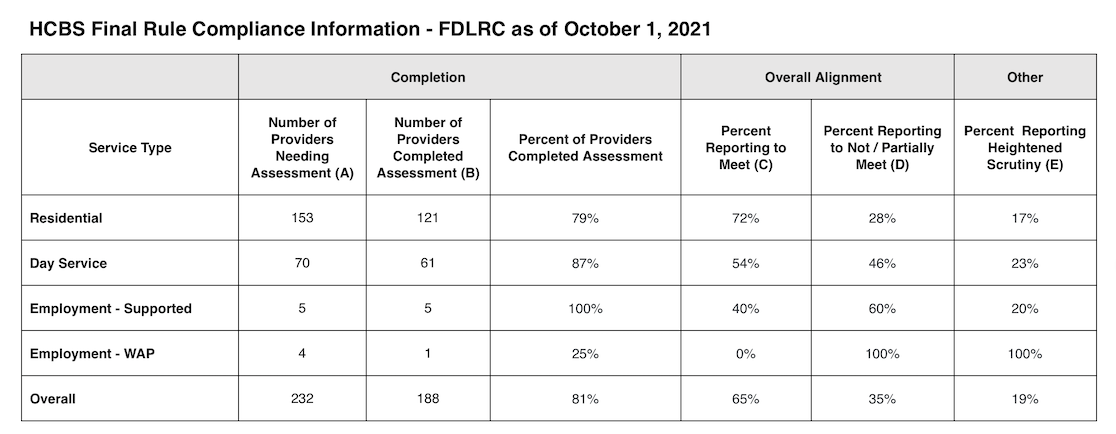

HCBS (CMS) Final Rule Compliance Report

In 2014, the Centers for Medicare & Medicaid Services (CMS) released new federal rules requiring residential services and day services to meet new requirements. Many services people receive are paid for with state and federal money from the federal Centers for Medicare and Medicaid Services (CMS). Therefore, California must comply with what is called the Home and Community-Based Services (HCBS) Final Rule. This rule sets requirements for the places where people live or receive services. The Final Rule says that settings must be integrated and support full access to the community. Each state has until March 2023 to help providers comply with the CMS requirements. For more information regarding the HCBS Final rule, please visit DDS’s website at https://www.dds.ca.gov/initiatives/cms-hcbs-regulations/.

Welfare and Institutions Code section 4519.2(b) requires each regional center to post information related to HCBS Final Rule compliance on its website. This information is to be updated at least every six months until DDS has determined that statewide compliance with the HCBS Final Rule has been met. To view the most current report, please click this link (data last updated 10.01.2021).

(A) Providers needing assessment is defined as providers that group individuals for services and are designed to serve individuals with developmental disabilities.

(B) Providers completed assessment is defined as providers that have completed the self-assessment or site assessment.

(C)* Providers reporting to meet is defined as providers reporting to meet all federal requirements in either the self-assessment or site assessment.

(D)* Providers reporting to not meet / partially meet is defined as providers reporting to not meet at least one of the federal requirements in either the self-assessment or site assessment.

(E)* Number of providers reporting in either the self-assessment or site assessment that they may meet heightened scrutiny requirements and require additional review.

*Percentages in these fields are based on the total number of completed assessments (B).

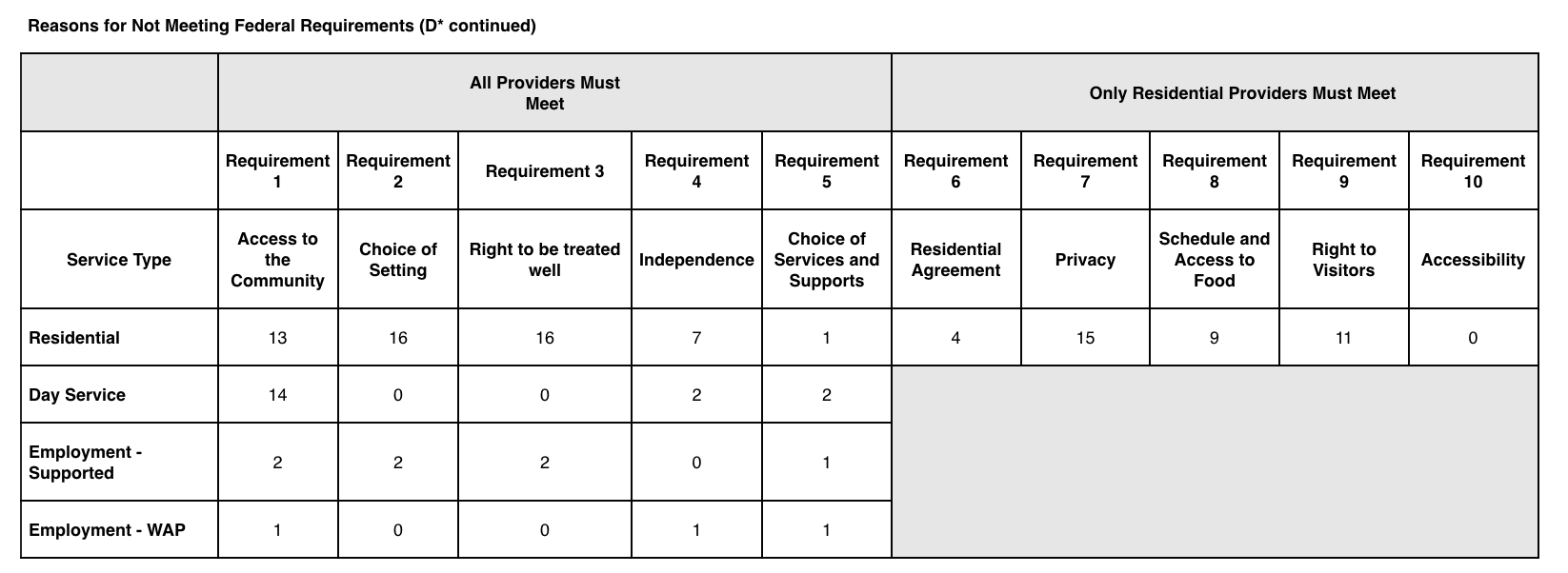

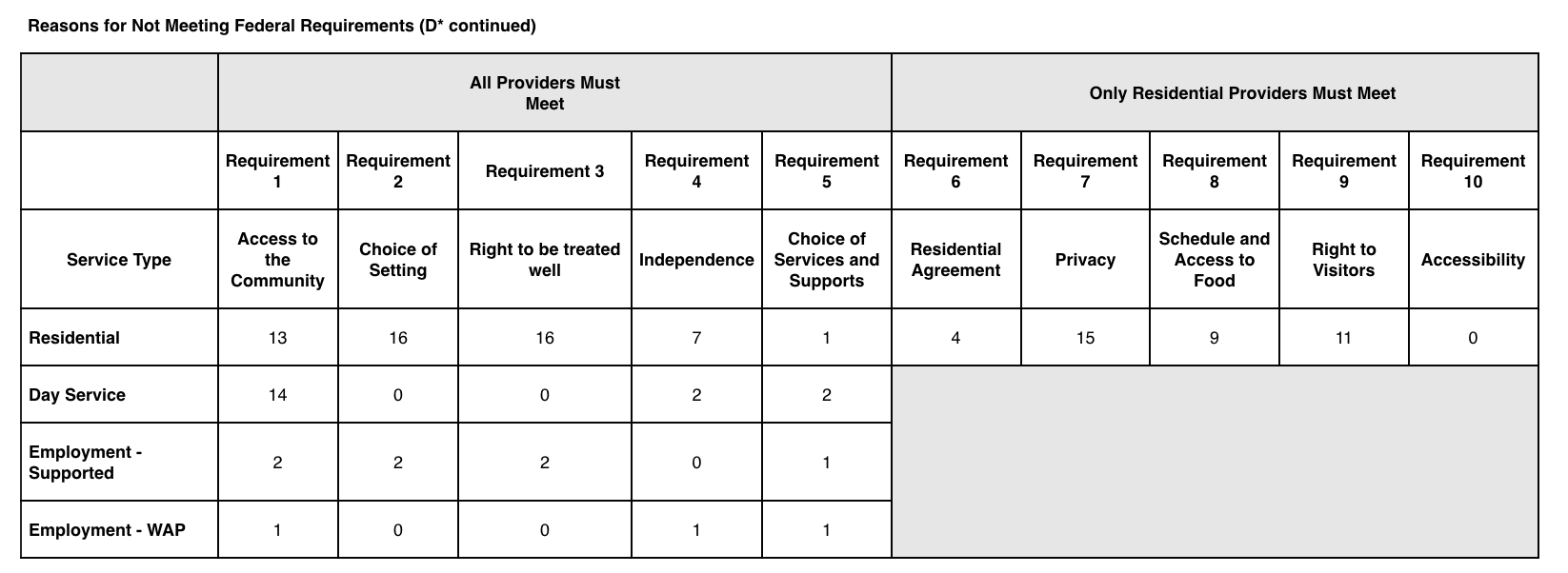

Reasons for Not Meeting Federal Requirements (D* continued)

(D continued) Will show trends of how providers across service types responded to each federal requirement. The numbers are based on providers reporting to not meet or partially meet each of the applicable federal requirements.

File

HCBS (CMS) Final Rule Compliance Report

In 2014, the Centers for Medicare & Medicaid Services (CMS) released new rules which say that service providers receiving CMS funds have to provide services which allow individuals to be part of their communities. This is known as the Home and Community-Based Services (HCBS) final rule. Each state has until March 2023 to help providers comply with the CMS requirements. For more information regarding the HCBS Final rule, please visit DDS’s website at https://www.dds.ca.gov/initiatives/cms-hcbs-regulations/.

Regional centers must post information regarding how providers are doing with ensuring individuals served are part of their communities (Welfare and Institutions Code section 4519.2(b)). This information is to be updated at least every six months until DDS has determined that statewide compliance has been met. View Lanterman’s most current report (data last updated 08/25/2020)

File

2020 State Minimum Wage Increase - Effective January 1, 2020

The state of California minimum wage increased on January 1, 2020 to $13.00 per hour for employers with 26 or more employees and $12.00 per hour for employers with 25 or fewer employees. The Department of Developmental Services (DDS) has been allocated additional funds by the Legislature for dissemination to service providers to meet the increased minimum wage mandate. It is important to note that the funds allocated by DDS are solely to meet service providers’ costs to increase employee/staff wages to $13.00 per hour (or $12.00 per hour based on the number of employees) and the associated mandated costs (i.e. Social Security, Medicare and workers’ compensation).

View the entire letter from DDS

Community Care Facilities (Alternative Residential Model Homes)

Residential service providers reimbursed under the Alternative Residential Model (ARM) rates, service codes 905, 910, 915 and 920 do not need to submit rate adjustment requests. DDS has already adjusted these rates and you will see them beginning with your January 2020 invoice.

View the new ARM rates for Level 2 – Level 4-I homes

Community-Based Day Programs, In-Home Respite Agencies and Work Activity Programs (DDS Set Rates)

Service providers classified as day programs, including infant development programs (service code 805), adult day programs (service codes 505, 510, 515), independent living services (service code 520), in-home respite agencies (service code 862) and Work Activity Programs (service code 954) may request a rate adjustment from DDS. For instructions and the workbook to request a rate adjustment from DDS, please go to www.dds.ca.gov/minwage/.

View the DDS Set Rates

Negotiated Rate Vendors

For service providers with negotiated rates (including median rates), Lanterman is requesting that you complete the Minimum Wage Cost Reporting Worksheet. To access this worksheet please click here. Providers with negotiated/median rates who employ 26 or more employees may request a rate adjustment if any employees/staff are paid less than $13.00 per hour. Providers with negotiated rates who employ 25 or fewer employees may request a rate adjustment if any employees/staff are paid less than $12.00 per hour. One vendor number per workbook.

NOTE: If you want to request a rate adjustment from Lanterman Regional Center due to the 2020 Minimum Wage increase, please complete the attached workbook and send it to providerservices@lanterman.org by 4 p.m. on March 1, 2020. Whether you are submitting your rate adjustment request to DDS or to Lanterman, the deadline to submit is March 1, 2020. Requests received after this date will not be considered.

Please carefully read the instructions to complete the workbook and follow all instructions. You may be asked to submit supporting documentation including payroll records, workers’ compensation insurance, DE-2088 and other data. Do not submit unless it is requested.

If you have questions or need further information please contact Karen Ingram at 213.252.5694 or kingram@lanterman.org.

Lanterman Needs a Family Home Agency

Frank D. Lanterman Regional Center intends to contract with a Family Home Agency (FHA). The FHA will provide services in accordance with Title 17 of the California Code of Regulations sections 56082 – 56099. Applications are due by July 31, 2019 and should be submitted to:

David Norman, Sr.

Resource Developer

Community Services Dept.

3303 Wilshire Blvd., Suite 700

Los Angeles, CA 90010.

Contact David Norman, Sr. at 213.252.6012 for more information.

File

DDS Vendor Rate Study and Rate Models Presentations

Following at the end of this are the presentations that have been shared at rate study meetings for Lanterman service providers. They are broken down into type of service provided.

Regional Center Specific Rate Models

View at: http://www.burnshealthpolicy.com/ca-regional-center-specific-rate-models/

Rate Study Fiscal Impact

The anticipated total cost of implementing the rate study recommendations is $1.8 billion (Total Fund), which is about $1.1 billion (General Fund) annually. Here is a link to the anticipated fiscal impact by service code ( ).

View at: http://www.burnshealthpolicy.com/wp-contenthttps://lanterman.org/uploads/2019/03/Attachment-5-Fiscal-Impact-Analysis.pdf

Rate Study Submitted by DDS to Legislature on March 15

The Department of Developmental Services (DDS) submitted the rate study on the provision of community-based services for individuals with developmental disabilities to the California Legislature on March 15.

The rate study includes four parts:

- Part 1 summarizes the various methodologies for establishing rates for home and community-based services and outlines current rates and methodologies in California.

- Part 2 provides an overview of the study, including the project’s timeline, principles adopted to guide the study, and data sources used to inform rates.

- Part 3 covers the major components of the rate models, including direct care worker wages, benefits and productivity, indirect costs such as program operations and provider administrative costs, and adjustments to account for regional cost differences.

- Part 4 provides a summary of the rate study results.

View a PDF copy of the rate study report

View the cover letter submitted to the Legislature.

The rate study report and links to supporting documents are also posted on the DDS website at https://www.dds.ca.gov/RateStudy/.

Files

State Minimum Wage Increase - Effective January 1, 2019

The State of California minimum wage increases to $12.00 per hour for employers with 26 or more employees and $11.00 per hour for employers with 25 or fewer employees. The Department of Developmental Services (DDS) has been allocated additional funds by the Legislature for dissemination to service providers to meet the increased minimum wage mandate. It is important to note that the funds allocated by DDS are solely to meet a service provider's costs to increase employee/staff wages to $12.00 per hour (or $11.00 per hour based on the number of employees) and the associated mandated costs (i.e. Social Security, Medicare and workers’ compensation).

Community Care Facilities (Alternative Residential Model (ARM) reimbursed)

Residential service providers reimbursed under the Alternative Residential Model (ARM) rates, service codes 905, 910, 915 and 920 do not need to submit rate adjustment requests. DDS has already adjusted these rates and you will see them beginning with your January 2019 invoice. View the new ARM rates can be found at: www.dds.ca.gov/Rates/docs/CCF_Rate_January2019.pdf

Community-Based Day Programs, In-Home Respite Agencies and Work Activity Programs

Service providers classified as day programs, including infant development programs (service code 805), adult day programs (service codes 505, 510, 515) and independent living services (service code 520), in-home respite agencies (service code 862) and Work Activity Programs (service code 954) may request a rate adjustment from DDS. For instructions and the workbook to reqeust a rate adjustment from DDS, visit: www.dds.ca.gov/minwage/

Negotiated Rate Vendors

For service providers with negotiated rates (including median rates), Lanterman is requesting that you complete the Minimum Wage Cost Reporting Workbook. Providers with negotiated/median rates who employ 26 or more employees may request a rate adjustment if any employees/staff are paid less than $12.00 per hour. Providers with negotiated rates who employ 25 or less employees may request a rate adjustment if any employees/staff are paid less than $11.00 per hour. You may only submit one vendor number per workbook.

Click here to access the workbook

NOTES:

Whether you are submitting your rate adjustment request to DDS or to Lanterman, the deadline to submit is March 1, 2019. Requests received after this date will not be considered.

Please carefully read the instructions to complete the workbook and follow all instructions. You may be asked to submit supporting documentation including payroll records, workers’ compensation insurance, DE-2088 and other data. Do not submit unless it is requested.

If you have questions or need further information please contact Lanterman's Community Services Department at providerservices@lanterman.org or 213.383.1300.

Files

Provider Rate Survey Must Be Completed by August 3

As required by Welfare and Institutions Code § 4519.8 (http://leginfo.legislature.ca.gov/faces/codes_displaySection.xhtml?lawCode=WIC§ionNum=4519.8), the California Department Developmental Services (DDS) is in the process of studying the reimbursement rates paid for community-based services for individuals with developmental disabilities.

Our organization, Burns & Associates, Inc. (B&A), is assisting DDS with this study. This assistance includes the administration of a vendor survey to collect data regarding providers’ service delivery designs and costs. B&A consulted with DDS and the Developmental Services Task Force’s Rates Workgroup to develop the Excel-based survey and accompanying instructions, which can be accessed at http://www.burnshealthpolicy.com/DDSVendorRates/.

B&A will be recording a series of webinars to explain the rate study and to walk through the survey page-by-page. The recordings will be posted to http://www.burnshealthpolicy.com/DDSVendorRates/ by the end of the day on May 29. Other project-related materials, including the survey and instructions attached to this e-mail, can also be found at this website. B&A has updated their Web site to include a Table of Contents with time marks for the Provider Survey webinars. The link following provides the exact time mark within the webinars where information pertaining to specific topics, and/or service codes can be located: http://www.burnshealthpolicy.com/wp-contenthttps://lanterman.org/uploads/2018/06/Webinar-TOC-and-Time-Marks.pdf.

Please note the following:

- Data collected through the survey will be a key consideration as DDS assesses the adequacy of current payment rates and studies possible changes to the rates. Thus, although the survey is voluntary, all vendors are encouraged to participate.

- The survey includes worksheets (‘tabs’) for every service code included within the survey. You should only complete forms for the services that your organization provides. The table of contents (‘TOC’) worksheet in the survey file lists the specific forms to complete for each service code. Similarly, the Service Listing page beginning on page 3 of the instructions directs you to the appropriate pages for directions for each survey worksheet.

- Information collected through the survey will be utilized only for the purpose of this rate study and vendors’ individual responses will not be released to DDS.

- Partially completed surveys will be accepted. You may skip any questions that request information that your agency cannot provide, and those portions of the survey that are completed will still be part of the survey analysis.

- If there are any factors that you believe should be considered but were not included in the survey, note those issues (and any other comments) in the transmittal e-mail when submitting the survey. You may also submit any other documentation that you would like considered as part of this study.

We recognize that the survey is lengthy and detailed. In addition to the recorded webinars noted above, you are encouraged to contact us with any questions at DDSProviderSurvey@burnshealthpolicy.com or 602.241.8515.

Completed surveys are due by Friday, August 3 and should be submitted to DDSProviderSurvey@burnshealthpolicy.com.

If you have any questions regarding the rate study, you may contact your local regional center or DDS at vendorsurvey@dds.ca.gov or 916.654.2300.

Additional Information on the provider survey can be found on the Department's Web site.

Disability Scoop Article on End to Subminimum Wage

Disability Scoop recently published an article written by Courtney Perkes called "Senators Call for End to Subminimum Wage Amid Accusations of Exploitation" written after an Illinois manufacturing company was accused of exploiting nearly 250 employees with disaiblities.

File

Legislative Analyst’s Office Report on Early Intervention

The Legislative Analyst’s Office (LAO) released a report titled “Evaluating California’s System for Serving Infants and Toddlers with Special Needs.” The LAO report contains several recommendations to improve outcomes in California’s provision of early intervention services. The report notes that the school system and regional centers both provide early intervention services. The schools provide early intervention services through the Legacy Program, and the Hearing, Visual, and Orthopedic Impairments (HVO) Program. The regional centers provide early intervention services through the Early Start program.

The report states that in order to adequately address timeline compliance issues and funding differences between education and regional center run early intervention programs, California should unify this bifurcated system. The LAO offers the opinion that the regional center system is better equipped to provide early intervention services to all children, and to generate state savings in the process.

File

SCDD Announces RFP

The Los Angeles Office of the State Council on Developmental Disabilities (SCDD) has announced a request for proposals, up to $20,000, that relate to at least one of the SCDD State Plan Goals, which include self-advocacy; employment; housing; health and safety; early intervention, education, transition and post-secondary education; and community supports.

Proposals are due on March 6, 2018, and a bidders conference call for those interested in submitting a proposal will be held on February 6, 2018 at 3 p.m.

File

State Minimum Wage Increase - Effective January 1, 2018

The State of California minimum wage increases to $11.00 per hour for employers with 26 or more employees and $10.50 per hour for employers with 25 or fewer employees. The Department of Developmental Services (DDS) has been allocated additional funds by the Legislature for dissemination to service providers to meet the increased minimum wage mandate. It is important to note that the funds allocated by DDS are solely to meet a service provider's costs to increase employee/staff wages to $11.00 per hour (or $10.50 per hour based on the number of employees) and the associated mandated costs (i.e. Social Security, Medicare and workers’ compensation).

Community Care Facilities (Alternative Residential Model (ARM) reimbursed)

Residential service providers reimbursed under the Alternative Residential Model (ARM) rates, service codes 905, 910, 915 and 920 do not need to submit rate adjustment requests. DDS has already adjusted these rates and you will see them beginning with your January 2018 invoice. The new ARM rates can be found at: www.dds.ca.gov/Rates/docs/CCF_Rate_January2018.pdf

Community-Based Day Programs, In-Home Respite Agencies and Work Activity Programs

Service providers classified as day programs, including infant development programs (service code 805), adult day programs (service codes 505, 510, 515) and independent living services (service code 520), in-home respite agencies (service code 862) and Work Activity Programs (service code 954) may request a rate adjustment from DDS. These service providers should navigate to the following Web sote for additional information: www.dds.ca.gov/minwage/?yr2018=1

Negotiated Rate Vendors

For service providers with negotiated rates, Lanterman is requesting that you complete the Minimum Wage Cost Reporting Workbook. Providers with negotiated rates who employ 26 or more employees may request a rate adjustment if any employees/staff are paid less than $11.00 per hour. Providers with negotiated rates who employ 25 or less employees may request a rate adjustment if any employees/staff are paid less than $10.50 per hour. You may only submit one vendor number per workbook.

Click here to access the workbook

NOTES:

Whether you are submitting your rate adjustment request to DDS or to Lanterman, the deadline to submit is March 1, 2018. Requests received after this date will not be considered.

The wage information provided on the worksheet must be for the period of July to September 2017. You may be asked to submit supporting documentation including payroll records, workers’ compensation insurance, DE-2088 and other data. Do not submit unless it is requested.

If you have questions or need further information please contact Lanterman's Community Services Department at providerservices@lanterman.org or 213.383.1300.

File

July 31 ~ Spots Available for “Bottom Dollars” Screening

The law establishing a federal minimum wage was passed in 1938. However, it included a provision that allowed people with disabilities to be paid less than minimum wage. This provision was designed to persuade employers to hire people with disabilities. Instead, people with disabilities were often employed in sheltered workshops earning sub-minimum wage. 79 years later, the sub-minimum wage provision still exists. In 2016, nearly 250,000 people were legally paid less than the minimum wage, on average about $2 an hour.

“Bottom Dollars” is a documentary that explores this issue in detail through personal stories and expert interviews. The SCDD L.A. Office in partnership with the Self-Advocacy Board of Los Angeles County and the Southern California Association of People Supporting Employment First (APSE) will be hosting a screening of “Bottom Dollars” followed by a panel discussion on Monday, July 31, 2017 from 10:30 a.m. to 12:30 p.m. at the California Endowment, 1000 N. Alameda St., Los Angeles, CA 90012.

File

Service Provider ABX2-1 Rate Increase Survey Due 09.15.17

With the enactment of Assembly Bill (ABX2-1) (Chapter 3, Statutes of 2016), programs that received a rate increase effective July 1, 2016, for the purpose of increasing wages and/or benefits for staff that spend a minimum of 75 percent of their time providing direct services to clients have a mandated requirement to complete the following survey.

The Department of Developmental Services (“DDS”), with regional center participation, must survey all service providers who received this rate increase effective July 1, 2016. The mandated survey must be completed no later than Sunday, October 1, 2017. In order to meet this statutory timeline, Lanterman requests that you complete the mandated survey on or before Friday, September 15, 2017.

We request that you complete the mandated survey by registering and logging into the following website links:

Step 1: Service Provider ABX2-1 Portal Registration Link (First Time/New User):

https://www.evoconportal.com/CADDS/authenticate.php

Step 2: Service Provider ABX2-1 Survey Link (Once registered, Use the following link to login into the portal to complete the survey):

https://www.evoconportal.com/CADDS/login.php

To assist you with completing the mandated survey, webinar trainings will be conducted on the following dates and times:

Webinar Title: ARCA/DDS ABX2-1 Survey Project Training – CA Vendors

Dial-In Number: 877-358-8686

Passcode: 1814233862#

Training Date and Time

Tuesday, July 25, 2017, 3 p.m. PST

https://attendee.gotowebinar.com/register/8440236467849628162

Friday, August 4, 2017, 1 p.m. PST

https://attendee.gotowebinar.com/register/2818882115775080706

Please know that the failure to complete the ABX2-1 rate survey(s) will result in your program(s) forfeiting the ABX2-1 rate increase. Therefore, we highly encourage you to complete the ABX2-1 rate survey by the established timeline above.

Should you have any questions about the ABX2-1 rate increase or need assistance, please contact one of the following Community Services staff:

Eduardo Del Rio, Provider Specialist – 213.252.5698 or edelrio@lanterman.org

Nellia Lippman, Provider Specialist – 213.252.6002 or nlippman@lanterman.org

Karen Ingram, Director of Community Services – 213.252.5694 or kingram@lanterman.org.

Files

City of Los Angeles & Pasadena Providers: Request Rate Adjustment Due to City Minimum Wage Increase

Effective July 1, 2017, the minimum wage in the city of Los Angeles and the city of Pasadena increases to $12.00 an hour. Providers can request a rate adjustment through the Health & Safety Waiver process. Please read the following notice to learn more.

View the notice to providers

Download the minimum wage worksheet

CDCAN Report: DDS Selects Arizona Firm to Conduct Regional Center Provider Rate Study

Following is an excerpt from the May 17, 2017 CDCAN Report:

The Department of Developmental Services (DDS) announced this week that it intends to contract with Burns and Associates, a Phoenix-based consulting firm, to conduct a long awaited regional center provider rate study and to provide recommendations for a “simplified rate setting methodology” for providing services and supports to eligible children and adults with developmental disabilities in California.

A rate study when completed – if viewed as credible, comprehensive and accurate by advocates and policymakers – could have sweeping impact on community-based services and supports for hundreds of thousands children and adults with developmental disabilities and their families, and thousands of community based providers and workers across California.

File

HCBS Regulations - Provider Funding for Compliance Activities

Please note...DDS has extended the deadline for submission to October 30, 2016.

On August 3, 2016, the Department sent the attached information regarding the process for requesting funding to assist providers in making changes to meet the federal Home and Community-Based Services (HCBS) settings requirements. To allow more time for the development and completion of these proposals, the Department is extending the deadline until October 30, 2016, for service providers to submit proposals to regional centers. The information received with these proposals regarding strategies to address needed changes will be very important as we move forward. Therefore, it’s essential that service providers are made aware of this opportunity to, in conjunction with clients and family members, develop ideas for needed changes to meet the HCBS requirements.

Survey of Vendors Regarding Authorization and Payment Issues and Satisfaction with Services Provided

At Lanterman, we are interested in looking at how we do things and if we can find ways to make improvements. As we have done in the past, we decided this year to conduct a survey of our vendors to gauge their satisfaction with services provided by our Accounting staff. We are pleased to share the results of the survey.

In May of this year, surveys were distributed to a sample of 120 service providers, 24 from each of the five Accounting Associates. Providers selected represented residential, day program, and other providers. Surveys were color-coded so responses could be grouped by Accounting Associate in addition to looking at overall results. A few weeks after the initial mailing, a reminder postcard was sent. In the end, we received responses from 58 providers for a response rate of about 48%. Each individual response, then, represents about 2 percentage points relative to each finding. Of the responses, 33% were from residential providers, 26% from day programs, and 41% from providers of other types of services.

View the entire survey results

City of Los Angeles and Pasadena Providers: Request Rate Adjustment Due to City Increase in Minimum

Effective July 1, 2016, the City of Los Angeles and the City of Pasadena have increased their minimum wage to $10.50 an hour. Service Providers with rates set by the regional center who need a rate adjustment should complete the attached worksheet (one per vendor number) and submit to providerservices@lanterman.org by September 30, 2016. Approved rate adjustments will be made retroactively to July 1, 2016. Requests received after September 30 will be considered, but will not be retroactive.

Please see the following letter for more information.

View the letter

Download the workbook

Provider Rate Increases

As a result of recent legislative changes, many providers received rate increases effective July 1, 2016. The amounts of the increases vary significantly. New authorization (106) forms are being sent out to providers that reflect these increases. In August, letters will be going out to providers that explain these increases in detail and the record keeping that may be required. Please contact Community Services staff at the Regional Center with any rate questions.

Impacts of the New Overtime Law

Attention – The new Overtime Law may impact you and your staff. Please click on the following link to learn more: www.dol.gov/featured/overtime/, then ask your Human Resources Director or Consultant how this applies to your company.

Here’s How the New Overtime Law Will Affect You

Federal overtime laws affect ALL employers.

Click here to learn more